Financial literacy: 17 tips to start saving

Financial literacy is a skill that isn’t taught in school, yet it can change your life. Most people make the same mistakes: living paycheck to paycheck, impulse buying, and having no plan for the future.

Studies show that 68% of people lack basic financial reserves, while 45% of young adults go into debt for non-essential items. If you don’t know where to start with organizing your finances, these are concrete tips that have helped thousands of people escape financial chaos and gain control over their money.

Contents

Key Point: Financial literacy isn’t a talent – it’s a learnable skill that requires discipline, patience, and continuous learning.

1. First Build an Emergency Fund – Foundation of Financial Security

Before you even think about investing, credit, or saving for a vacation, create an emergency fund. This isn’t optional – it’s an obligation to yourself. The fund should cover at least 6 months of your living expenses, ideally 8-12 months.

Why is this so important? Because life is unpredictable – job loss, illness, car repairs, or family crises can throw you into debt if you don’t have reserves. The average person remains unemployed for 8.3 months before finding a new job. Without financial reserves, you’re forced to take any job for less money.

Practical Tip: Calculate your basic monthly expenses (rent, food, bills, minimum obligations) and multiply by 6. That’s your emergency fund goal.

2. Don’t Increase Expenses When Your Salary Rises – Golden Rule of the Wealthy

The biggest financial mistake is lifestyle inflation – when your salary increases by 20%, expenses increase by 30%. A higher salary isn’t an excuse for a more luxurious life – it’s an opportunity to invest and save more.

Wealthy people live below their means. Warren Buffett, one of the richest people in the world, still lives in the house he bought in 1958 for $31,500. When you get a raise, automatically transfer the additional amount to a savings account before you get used to higher expenses.

3. If You Can’t Buy It With Cash, You Can’t Afford It

Except for real estate and cars (and only if you need them for work), everything else that requires credit is beyond your means. Installment loans are often traps that keep you in a vicious cycle of debt.

Warning: Credit cards have interest rates of 15-25% annually. If you pay only the minimum, a debt of $1,500 could take you 15 years to pay off!

4. Only Invest in What You Understand

Don’t blindly follow other people’s advice, especially those promising quick profits. If you don’t understand crypto, stocks, or funds – first educate yourself through authoritative sources like Investopedia’s Financial Literacy Guide.

Real investment returns are 5-8% annually on average, and that’s with risk. There’s no quick profit without big risk. Anyone promising you more than 15% annually is probably trying to scam you.

5. You Haven’t Saved Anything If You Bought Something on Sale That You Don’t Need

The marketing industry spends billions to convince you to buy things you don’t need. Discounts, sales, “limited offers” – it’s all designed to make you impulse buy.

Before buying anything more expensive than $100, wait 24 hours. For things more expensive than $500, wait a week. You’ll often realize you don’t need that thing at all.

6. Avoid Betting and Games of Chance

It’s okay to occasionally buy a lottery ticket for fun, but don’t spend money on hope. Mathematical expectations are always in favor of the house. If you roll dice enough times, you’ll always lose.

Over a billion dollars is gambled away annually in many countries. That’s an average of $260 per person! Instead of gambling, put that money into investments.

7. Learn Budgeting – The 50/30/20 Rule

Start tracking your expenses and make rules. The popular 50/30/20 formula is:

- 50% for basic expenses (rent, food, bills, transport)

- 30% for wants (entertainment, clothing, restaurants)

- 20% for savings and investments (emergency fund + investments)

If you can’t save 20%, start with 10% or even 5%. The important thing is to start, not to be perfect from day one.

8. Pay Yourself First – Automatic Savings

As soon as you get your salary, transfer part of it to a separate account. If you don’t see it, you won’t spend it. Set up automatic savings – this way you create reserves without effort.

Tip: Open a savings account at another bank without a card. The harder it is to access the money, the less likely you are to spend it.

9. Get Information from Reliable Sources

YouTube channels like “Personal Finance Plan”, as well as books like “Rich Dad Poor Dad” can help you understand money basics. Beware of “gurus” selling courses for quick profits – they’re usually scams.

10. Money is a Tool, Not a Goal

Cars, watches, clothes – these are tools, not status symbols. You don’t have to impress anyone. The goal is freedom, not luxury. Financial independence means you can choose what to do, not be forced to do anything.

11. Retirement System and Protection from Inflation

Saving in cash isn’t enough – inflation eats your money. In the last 10 years, inflation has averaged 2-3% annually. This means your money loses value if it doesn’t grow at least that much.

Consider private retirement insurance (401k/IRA), but also direct investments in stock funds with knowledge. Diversification is key – don’t put all your eggs in one basket.

Also check out our article – Financial Literacy – Basic Terms

12. Two Basic Rules: Spend Less – Earn More

Sometimes it’s hard to save because you simply don’t have enough. Then the only solution is to earn more – through side jobs, freelancing, education that will increase your value in the job market.

Invest in skills that are in demand: programming, digital marketing, foreign languages, sales. In the digital age, you can work for clients from around the world.

13. Practical Examples and Calculations – Power of Compound Interest

Here’s a concrete example for an average salary of $1,000 net:

- $500 – basic expenses (rent, food, bills)

- $300 – wants and entertainment

- $200 – savings and investments

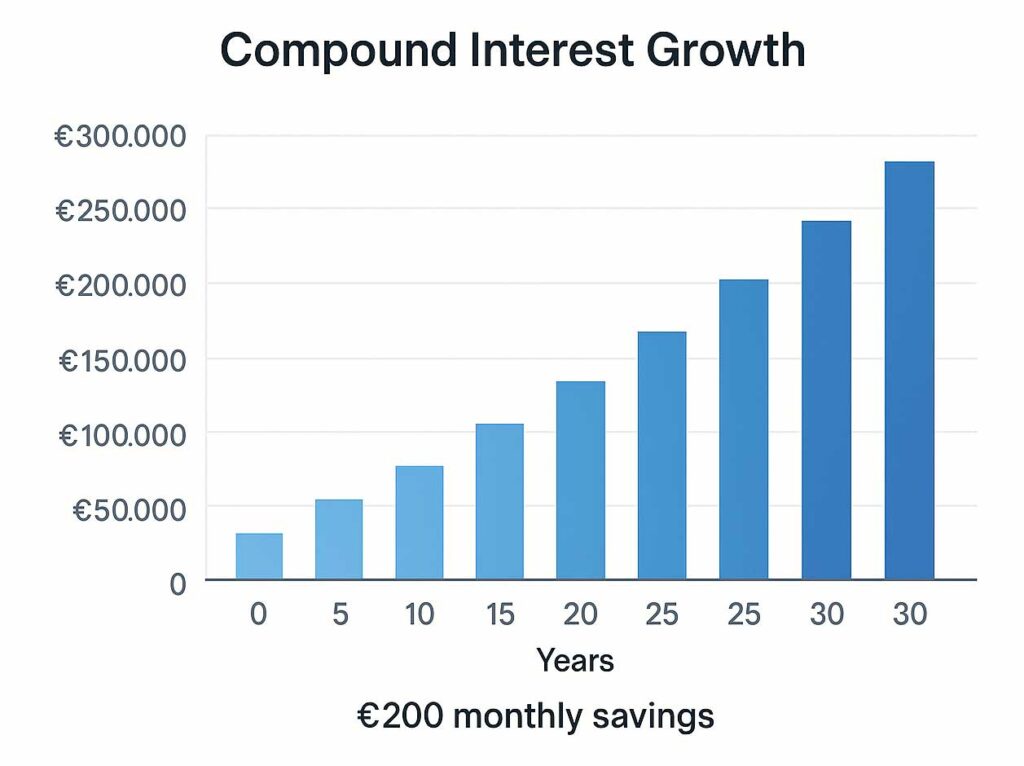

If you save $200 every month with an average return of 7% annually:

- After 5 years: $14,300

- After 10 years: $33,000

- After 20 years: $98,000

- After 30 years: $245,000

The cost of not saving: If you spend those $200 monthly on coffee, cigarettes and impulse purchases, in 30 years you’ll “spend” $245,000 of future wealth!

14. Common Mistakes and How to Avoid Them

Mistake #1: “I’m buying on installments because it’s the same price”

It’s not the same! When you buy on installments, you lose the opportunity to invest that money. If instead of buying a $1,500 TV in 24 installments you invest those $65 monthly, in 20 years you’ll have over $30,000.